The Economics of L3s

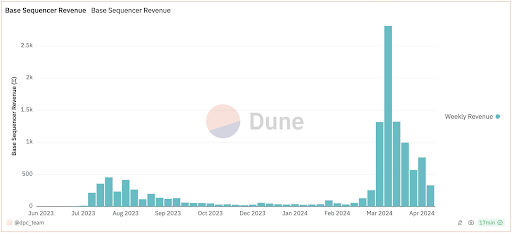

As discussed in our last post, L3s face real challenges related to economic sustainability. While Base generated over $30 million in sequencer revenue in the first quarter of 2024 alone, what’s working for a small number of L2s like Base, Arbitrum, OP Mainnet, and Polygon won’t also work for L3s.

As discussed in our last post, L3s face real challenges related to economic sustainability.

While Base generated over $30 million in sequencer revenue in the first quarter of 2024 alone, what’s working for a small number of L2s like Base, Arbitrum, OP Mainnet, and Polygon won’t also work for L3s. Why not?

Today, L3s are gaining popularity due to their ability to dramatically reduce fees for users and developers—opening the potential for new fully onchain applications, games, and experiences to be built. Similar to how cloud computing reduced the cost and time to build web applications by 10,000x, L3s could do the same for web3, enabling new-to-world networks to be built 10,000x faster and cheaper. That’s the theory at least.

However, 10,000x lower fees also create a significant economic challenge for L3s: dramatically lower fees means that they can’t rely on sequencer fees as their primary revenue source unless they have L2-like transaction volumes, which for nearly all L3s is infeasible. Additionally, to be 10,000x cheaper, the cost to run an L3 still needs to be reduced by another 10x to 100x from where they are today. This will require a radical—not incremental—transformation of the infrastructure for L3s.

This creates a serious economic dilemma for L3s. How can L3s hope to solve this?

Breakeven Analysis of L3s

Through our work with the burgeoning L3 ecosystem, our team at Syndicate has seen L3s attempt to combat this challenge by increasing their networks’ fees to generate a profit (or at least try to breakeven) from their sequencers. To date, these efforts have not yet led to profitability.

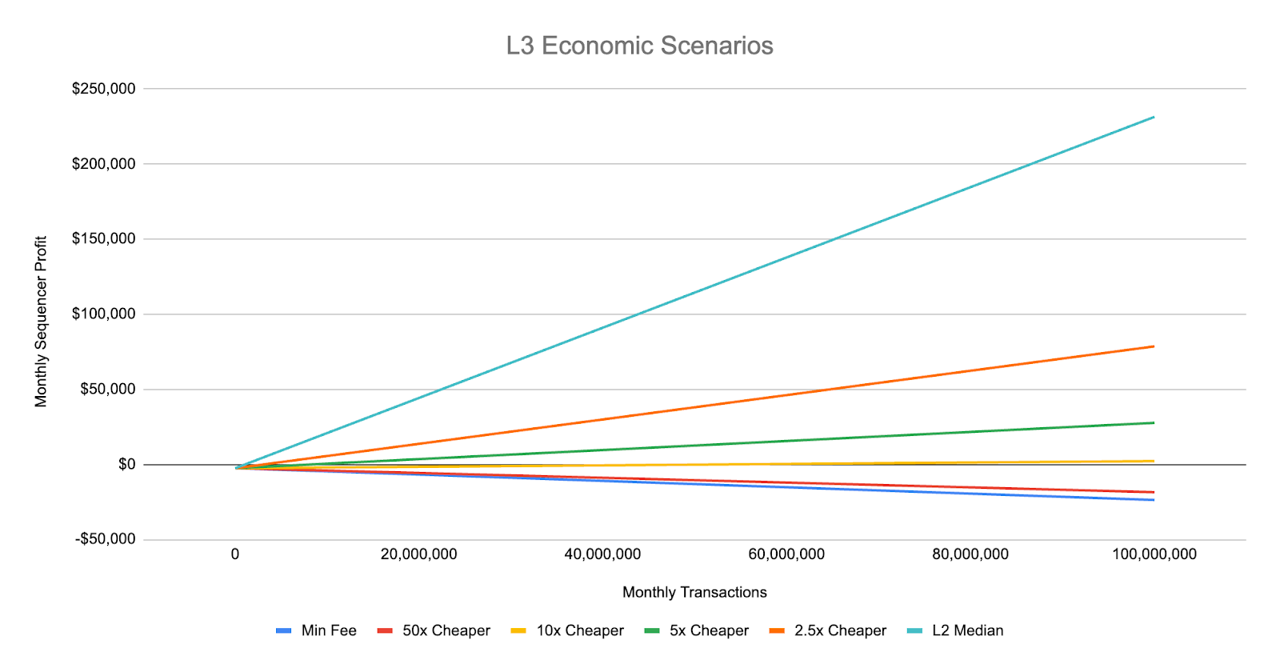

A few months ago, we conducted an economic scenario analysis of L3s—at various onchain activity and fee levels in relation to L2s—to understand their pathways to breakeven and profitability. The results are sobering.

If an L3’s fees are 10x cheaper (or more) than today’s L2s, the L3 is never able to turn a profit unless it has over 50 million transactions per month. That’s over 50% the activity of Base or 75% the activity of Arbitrum.

Base and Arbitrum—Ethereum’s two most active L2s—typically see between 50 to 100 million transactions per month on their networks. But those are the biggest players. In the last 30 days, Zora saw 3.8 million, Mode saw 3.8 million, and Redstone saw 1.1 million transactions.

To breakeven, an L3 with 5 million transactions per month would need to set their fees no more than 3x cheaper than L2s. That’s a big challenge, especially if an L3 is primarily competing on lower fees. Being only 3x cheaper than L2s is nowhere near enough to compel users and developers to adopt a new network. As a result, L3s must differentiate from L2s on other dimensions like scalability, customizability, and community ownership.

Only two L3s have seen more than 5 million transactions over the last 30 days, and they’re both focused on gaming: Xai (275 million transactions) and Proof of Play Apex (69 million transactions). Xai’s network fees are nearly 200x lower than L2s, which means it’s likely running at a loss. Proof of Play Apex’s network fees, on the other hand, are 15x more expensive than L2s, which means it could be running at a profit depending on who is paying for the fees.

But given all of this, what then are the pathways for L3s (and L2s for that matter) to sustainability and becoming valuable long-term?

The Argument for L3s Today

Today, L3s are best understood as a near-term “operating cost” or “cost center,” with the aim to bootstrap the development of a new network that will grow to become valuable over time. Additionally, by running the sequencer, setting the network fees, and using a custom gas token, L3s also provide operators with new economic tools to dynamically grow and manage their ecosystems—of users, developers, applications, and partners—through targeted gas subsidies and incentives.

For example, consider a fully onchain game that exists on an L2 and pays transaction fees for each onchain action. To improve the UX, the game developer might want to sponsor many (or all) transactions on behalf of the user, which would be costly as the game grows. Even with low gas fees on popular L2s today, if a game has 50,000 DAUs where players make on average 100 onchain actions daily, that totals to over $10,000 in sponsored gas fees per day (or nearly $5 million in gas fees per year). For many L2s that number could grow to as large as $25 million to $50 million a year! Therefore, a game built on its own L3 would decrease these variable costs down to near zero, making many new mainstream social, gaming, and consumer applications—that are onchain—economically feasible.

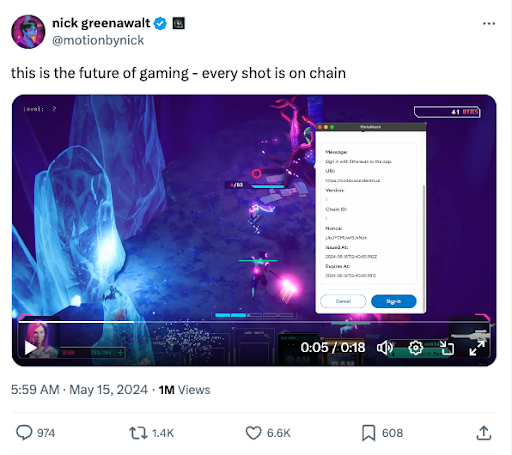

Being “fully onchain” is also a major selling point for some games and applications. For example, Skyoneer is a fully onchain game on its strategy game-focused L3 called Gold. Pirates Nation, another fully onchain game on Proof of Play Apex L3, says the following: “When a game is onchain it means that we are not running any servers. We can’t shut the game down and it’ll live on forever... Onchain games... guarantee permanence, interoperability, and composability.” Here, lower costs are not a direct selling point to the user, but they’re necessary to make the other benefits of the game being fully onchain feasible.

Ultra-low fees also unlock new use cases that users might not have otherwise engaged with. Consider Ham Chain which recently enabled new tipping and microtransaction experiences on their L3 by significantly lowering the costs of each transaction.

As such, the primary economic benefit of L3s is not in revenue generation but in the value they provide to the applications built on top of them. By dramatically reducing transaction costs, L3s enable new applications and business models that might not be economically viable on more expensive L1 or L2 networks, and they allow applications to retain more value in the form of lower costs for themselves.

The Economic Opportunities of L3s Tomorrow

While L3s may be viewed as a cost center or negligible source of revenue today, our team has a clearer vision for how L3s will become increasingly sustainable and valuable in the future. There are novel models on the horizon that will profoundly reshape L3 economics for developers and users alike.

The most obvious example is priority fees. As more applications, users, and transactions move over time to L3s, we’ll likely see the emergence of a priority fee market for popular L3s in the areas of gaming, social, and finance. Of course, priority fee markets where users are willing to pay extra for faster transactions would open only if the activity on L3s grows to a point where blockspace is no longer abundant like we see on Ethereum L1 and popular L2s like Base today.

However, a more innovative model we’ve already started to see is the use of a native gas and/or staking token for the L3. For example, Degen Chain uses $DEGEN as its native gas token, creating additional utility for $DEGEN. New L3s in development are not only planning networks with their own custom gas token but also custom staking mechanisms to help secure or co-operate the network, imbuing their tokens with even more utility. By using a native token—rather than solely focusing on the value created through sequencer profits—many L3s are exploring ways to create value through their native token. And in some cases like Degen, this is a much bigger value driver and opportunity than sequencer profits.

Still, there are even bigger economic breakthroughs on the horizon. Our team has been going deep into the development and issues for L3s to fight for growth and long-term sustainability, and through this work, we’ve uncovered big problems (and opportunities) related to how L3s are designed and operated that ultimately limit their economic agency and potential today. However, if you can change how L3s are designed and operate from the ground up—you can unlock new revenue, new markets, and major structural advantages. This means that in the near future, L3s will not only be 1000x cheaper but also will be able to access new opportunities to generate revenue and value that are not possible today. We look forward to sharing our research and work in this area in the coming weeks ahead.

What’s Next?

As L3s continue to evolve, we’ll see many new experiments in the areas of value creation and capture, both from the perspective of chain operators as well as the developers and users themselves.

If you’re building or operating an L3, or are thinking through novel value creation and capture mechanisms for onchain networks and communities, we would love to chat. Please reach out.